The use of payment cards has exploded in popularity in recent years. The ubiquitous acceptance of payment cards accounts for their popularity. The most well-known aspect of payment cards is the ease you can use them.

Payment cards have significantly surpassed other forms of payment, such as cash and checks. In fact, according to research published by the Global Economy, an open resource for learning about the global economy, by 2017, over 44% of the world’s population had used payment cards.

Without a doubt, this number has increased dramatically over time. The transition to online purchasing is one of the causes that has boosted the popularity of credit cards. During the Covid-19 pandemic, when people avoided physical contact, the number of users surged tremendously.

In 1950, the development of playing cards began. This was when card issuers began to produce several forms of payment cards, including debit and credit cards.

Both credit and debit cards have remained important in the financial industry up to this point. Aside from ease, these cars’ other remarkable characteristics have propelled them to the pinnacle of payment ways.

Versatility, security, and simplicity are just a few of the characteristics built into credit cards. In addition, the majority of these cards have agreements with processing businesses like MasterCard and Visa.

These processing providers have partnered with the majority of crypto debit cards. The Club Swan card, which has a MasterCard connection, is a nice example.

Thanks to these processing firms, you may use your payment card practically everywhere in the world. Purchases can be made online or in-store from anywhere in the world. More crucially, you can easily make ATM withdrawals if you use these companies’ payment cards.

Contents

The Road to a Cashless World

Before the Covid-19 outbreak, some countries had begun transitioning to a cashless economy. China and Australia are two examples of these countries.

Other countries, on the other hand, are far behind and are yet to catch up to these developed nations.

According to statistics, the majority of consumers choose to make payments without using cash. This is due to a worry of contracting Covid-19 while handling currency.

The number of ATM users surged significantly as a result of the pandemic. At the same time, the number of people using mobile money has skyrocketed.

What Lead to Advancement from Physical Cards to Digital cards? After nearly 70 years of operation, most physical card issuers are currently switching their cards to digital cards. The number of debit and credit card issuers has increased dramatically in recent years.

So, what led to the current transition from physical to digital cards? Physical payment cards become the norm during the Covid-19 epidemic. Even better, many others signed up for a card due to this. However, this dominance was short-lived due to transmission difficulties with these payment cards.

Furthermore, the expansion of the eCommerce business has pushed the use of payment cards to its limits. However, most card issuers felt the need to create digital virtual cards due to the rapid increase.

These virtual payment cards are exact replicas of physical payment cards, but they are handier for online transactions.

What is the Evolution of Payment Cards?

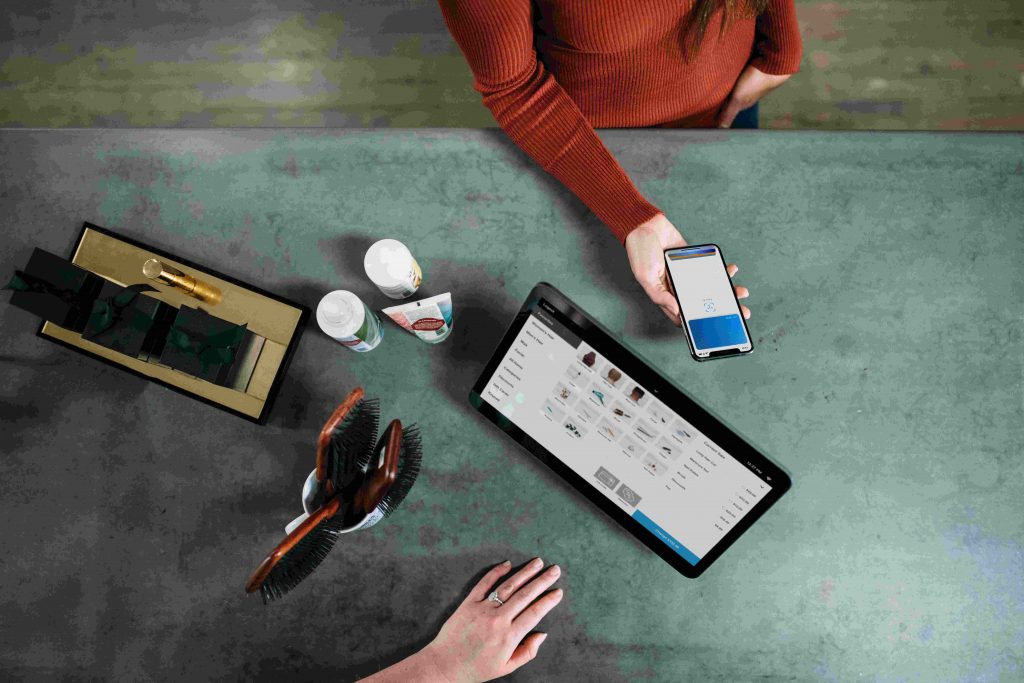

One of the most exciting aspects of the fintech world is the evolution of payment cards. One of the most impressive aspects of smart cards is their ability to interface seamlessly with mobile apps.

The majority of payment cards available today are mobile-centric. This means you can use an app on your smartphone to handle your payment card. These apps let you manage most of your card’s functions based on events.

For example, most crypto payment cards, such as Club Swan, have an app that allows you to adjust their functionality. You may manage your spending on the applications in addition to features.

Security is one of the aspects that you can handle on this mobile app. Issuers have offered owners additional control over the security of their crypto with these cards.

The security features included in this are cutting-edge. Biometrics, passcodes, and two-factor authentication are among them.

These mobile apps also allow you to manage your security. For example, you can freeze or change the pin if your digital card is lost. Additionally, you can use the mobile app to report the card’s loss.

In the fintech world, digital payment cards are still in their infancy. However, as time passes, it’s safe to assume that developers will want to make these automobiles more user-friendly. This will be a watershed moment that will alter our entire perception of payment cards.

When it comes to fiat currency, Apple Pay is a great example. Apple Pay has transformed the way people think about actual payment cards, making it more desirable.

You’ll need an Apple ID to set up an Apple Pay app. Thanks to this app, you can use your iPhone to make cardless, cashless, and contactless transactions.

There has been a lot of adoption of digital wallets in the world recently. As a result, it’s accurate to say that these cards are gradually becoming the payment card’s backbone.

Even though most payment cards continue to function, digital wallets have improved their security, efficiency, and convenience.

Other key breakthroughs in this spectrum, aside from digital payment cards, are expected. One of these advancements is using bots and artificial intelligence (AI) to complete transactions.

There are already some AI assistants on the market. Amazon Echo, Siri, and Google Now are examples of AI assistants. The success of this technology will be measured by how easily transactions can be completed using voice instructions.

The Look and Feel Factor of Payment Cards

Although payment cards offer their customers top-notch convenience and security, there is still a long way to go. We anticipate that the cards will be exceedingly convenient in the future. People also expect an increase in the security of these cards.

Improved security is required to eliminate or reduce the number of fraud incidents involving these cards. According to the BBC, the world’s leading public service broadcaster, fraud charges increased dramatically during the Covid-19 period.

According to one of their reports, they had over 6,000 fraud instances, resulting in a loss of over £34.5 million. Because of the rise in these circumstances, both card issuers and users must strive for better security measures.

Aside from security, environmental experts believe that using sustainable materials to make these cards is preferable. The key reason is that it will significantly contribute to environmental conservation.

Using ocean plastic is one of the solutions. Card issuers can also make environmentally friendly cards using biodegradable or recyclable materials.

Most payment cards, on the other hand, have nearly identical patterns. As a result, most cards are unappealing to the users’ eyes. As a result, most card issuers have recently begun to change their card designs.

Payment Methods of the Future

The fintech landscape is changing at an insane pace. As a result, there is a good chance that payment cards will be developed entirely or replaced.

The following are some of the industry’s up-and-coming payment methods:

1. Biometric Payments

Most smartphones have recently included fingerprint recognition as a security feature. This technology is one of the many that the developers have contemplated implementing into payment methods.

Aside from fingerprint scanning, the pupil is also scanned. This technique will also considerably enhance the security of your cryptocurrency or cash.

In other words, using credit and debit cards will be mandatory.

2. Voice recognition

Voice recognition isn’t a brand-new concept. It is, however, likely to find its way into the fintech world.

Until now, standard speech recognition technology hasn’t been able to recognize the distinctiveness of your voice. Fintech developers, on the other hand, are attempting to harness this skill to make payments and transactions voice-controlled.

Through a set of algorithms, this payment technology will recognize the uniqueness of your speech.

3. Digital Wallets

One of the most recent innovations in the fintech world is this. Smartphone wallets are another name for them. Apps like Google Wallet, PayPal, and Square Cash are often used.

These wallets make it simple to link to your cryptocurrency or bank account. As a result, you can use these wallets to conduct simple and contactless purchases. It’s also easier to make payments by connecting to retail terminals now that NFC (Near Field Communication) is in play.

Conclusion

In summary, new and more advanced payment mechanisms will emerge as time goes on. As a result, it is up to developers to create payment solutions that satisfy people’s needs.